Christian Bonneau, BComm 06, Managing Director, Head of North America and Timber - Natural Resources, PSP Investments

Bonneau has been a mentor, guest speaker and coach for academic case competitions since graduating from the program as part of the Class of 2005. As one of the first Kenneth Woods graduates to join PSP Investments, he has strongly encouraged recruiting students from the program to PSP.

"I think the fit is excellent,” says Bonneau. "PSP offers a variety of options depending on one’s career interests – whether private (i.e. Natural Resources, Private Equity, Infrastructure, Real Estate, Credit Investments) or public markets. Meanwhile, the KW program consistently generates high quality candidates who are keen to learn and grow, many of whom have stuck around and become key contributors at PSP."

He says despite changes in the market over the last twenty years, the Kenneth Woods program continues to stand out for its quality – both in its students and in its leadership.

"In this business, you will fail almost as often as you succeed," he says. "I believe the key to long-term success goes beyond the technical capabilities and is more about the attitude, effort and commitment of the individuals involved."

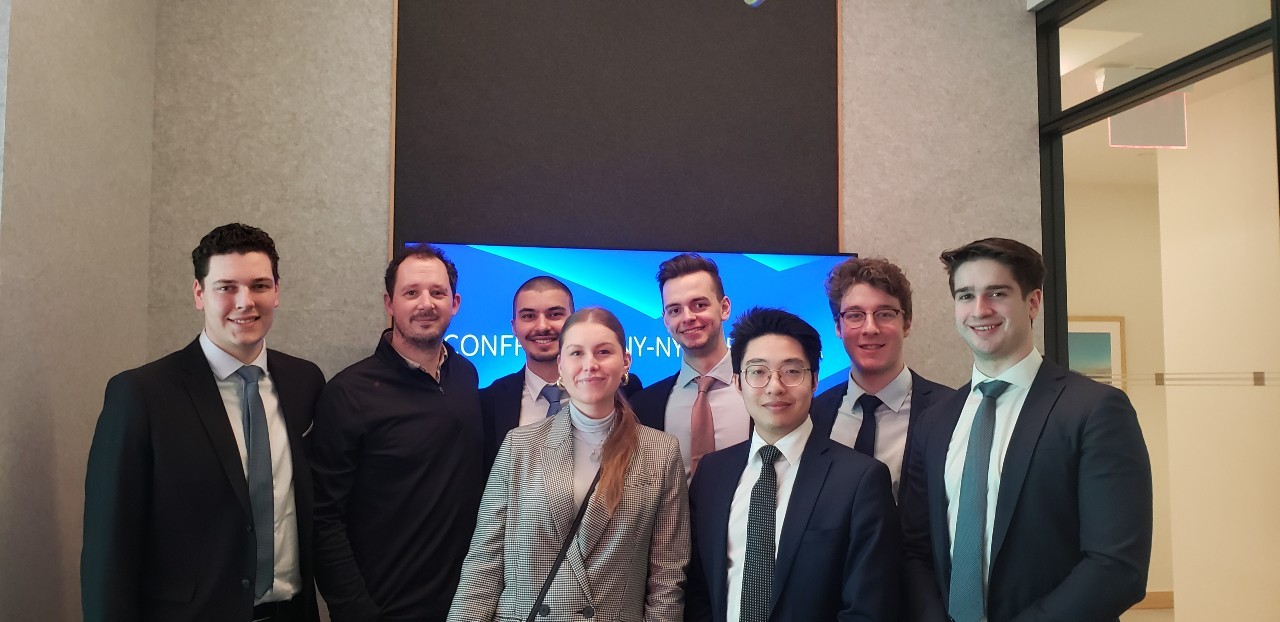

Michael Knight, BComm 12, second from left, hosting KWPMP students at Merrill Lynch’s office in New York City

Michael Knight, BComm 12, second from left, hosting KWPMP students at Merrill Lynch’s office in New York City